Needs Versus Wants In Budgeting

Today’s topic for Financial Literacy Month 2014: Your Finances from A to Z is Needs Versus Wants

Today’s topic for Financial Literacy Month 2014: Your Finances from A to Z is Needs Versus Wants

For the month of April, we will be bringing you daily posts centered on our personal finances – saving, making and managing our money.

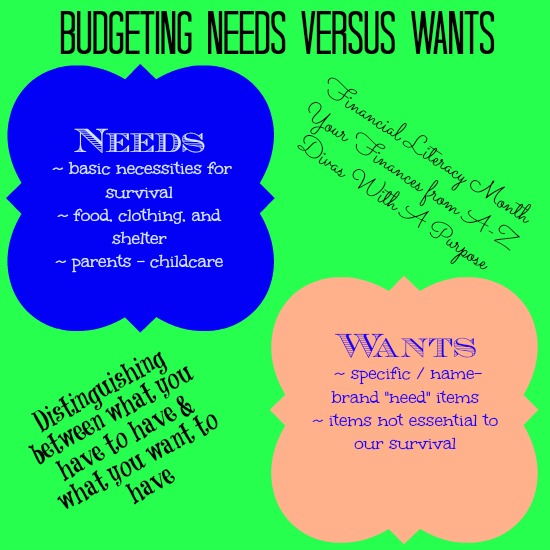

Needs are fairly easy to be identify. Our basic survival needs are food, water, shelter and clothing. As a parent, I classify reliable childcare as a need. Most parents will agree that without reliable childcare, we are unable to work or obtain work. There has even been attention in the news of late regarding women who had to make drastic choices when going on interviews because of their lack of childcare.

Wants are everything that do not fall within the need category. The line between need and want can become blurred when we begin becoming specific with our needs – we need water, but we want a specific bottled water brand.

Many of our wants can be eliminated or traded for less expensive options to help with our journey to saving or debt pay-off.