Budgeting Basics 101 – Financial Life Lessons

It seems like budgeting has always been a part of my vocabulary. Growing up, I’d often see my mother with her ledger book, checkbook and file folder of bills. Whenever I’d get an allowance or gift money, it was mandated that I give a portion to church (tithe) and give some to my mother to put into my savings account.

Once I began working at 16 and getting what I thought was a huge amount of money – all that I was taught went out the window. I worked full-time my junior and senior year of high school and had absolutely nothing to show for it upon graduation. If I could go back in time and shake myself silly, I most definitely would.

My mother tried her hardest to instill the importance of savings and budgeting basics in me, but she, also, allowed me to make mistakes with my money. I’m not entirely sure how I feel about that. Part of me knows that I was being given a slow introduction to the adult world while still in a safe bubble. Another part of me feels that my financial outlook as an adult would have been a little different if more one-on-one, direct conversations were had about budgeting, savings and being frugal.

Now that I’m a parent, I want to not only show my children how to be financially fit – I want to have conversations with them and show them how and why it will benefit in the long run.

How did your early experiences with budgeting shape your current outlook?

Honesty time – how many of us have ever created a true household budget and attempted to stick with it? Bonus points if you implemented it for more than a week!

Let’s be real – if sticking to budgets was easy for me, then this blog wouldn’t even be necessary! I used to think that my biggest struggle with budgeting was lack of funds – WRONG! It’s lack of discipline on my part with saying no and learning how to live within my means. As I grow, I’m learning that if there’s a deficit in my budget then I need to either find something to cut or find a way to bring in more money. I know, I know, I know – often easier said then done but it’s all in our attitude and approach.

Budgeting Basics Step-by-Step

STEP 1 – Add up your income from all sources.

STEP 2 – List all of your expenses and prioritize them. Downloading your transactions from your online bank to Excel helps with this and the following steps. Identify fixed and discretionary expenses.

STEP 3 – Review your discretionary expenses and (sigh!) see what needs to be trimmed and/or eliminated. Identify where your hot buttons are – dining out, Target, Starbucks, cell phone bill, etc- and make some tough decisions. This step often is where many stop and continue with business as usual because making changes and sacrifices is not easy at all!

STEP 4 – Review your long-term goals and that list of things you’d do if money was not an object – use that as inspiration to sacrifice for a short period of time for long-term benefits.

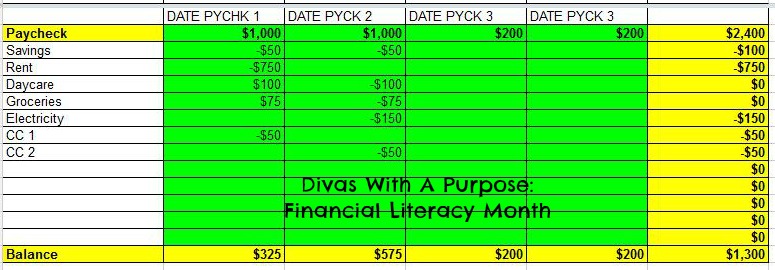

STEP 5 – I use a spreadsheet similar to the one below to determine what gets paid when and track how much I have to put aside and pay off additional debt. I’ll be honest there are lots of week when the final number is negative when I first put everything in and I have to use some creative accounting and just realize that there are some things that just won’t get paid.

STEP 6 – Budget to reward yourself within reason on a regular basis – monthly or quarterly. You’re working hard and deserve it. Make sure they are economical and reasonable rewards.

STEP 7 – Find a system that works for you – ledger book, online accounting system, spreadsheets, etc – and use it to help keep you organized and on track with your budget.

What step of the budgeting process is most difficult for you?

What works best for you when creating a budget?