How To Succeed At The 52 Week Money Challenge

With a new year comes goals, resolutions and promises to “get right”. Finance is an area that is often at the top of many a list and you may have seen the 52 Week Money Challenge come through your social media feeds.

The basic concept of the plan is to save a specific dollar amount each week of the year. The most common one is to save $1 week 1, $2 week 2, etc. Some variations suggest reversing it and saving $52 week 1, $51 week 2, etc. to get the larger dollar amounts out of the way early on.

Related Article: How To Save $1000 in 90 Days

I love the concept because it appeals to just about everyone – especially people who do not save regularly. My great things can come from saving with the tiniest of starts”

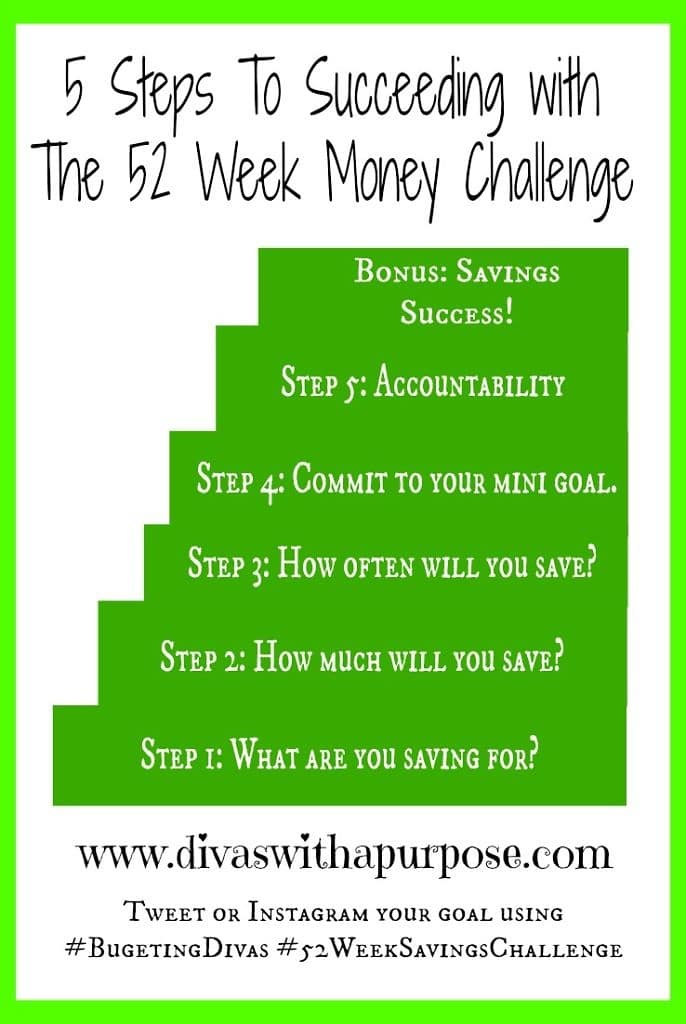

5 Steps To Succeeding With The 52 Week Money Challenge

Step 1: Determine what you are saving for? Having a tangible savings goal will help to keep you focused and motivated.

Step 2: How much will you save this year? Is there a specific, reasonable dollar amount you need to save for your goal? The great thing about the 52 Week Savings Challenge is that the dollar amounts are pre-set, but you can and should tweak them to your personal needs.

Step 3: How often will you save? The easiest way to save is to base it on when you receive your income. If you’re saving small amounts daily, divide your amount from step 2 by 365 to see your daily goal. Weekly – Divide by 52. Bi-weekly – divide by 26. Monthly – Divide by 12.

Step 4: What is your mini savings goal? Write out your savings goal or make a visual and place somewhere you’ll see regularly. Example: I will save $____ every _______.

Step 5: Accountability will help keep you on track. Link up with an accountability partner to keep you on track. If you’re on social media, Tweet or Instagram your goal using #BudgetingDivas #52WeekSavingsChallenge to join up with fellow divas committed to learning to save, make and manage our finances.

Simple Ways to Save Money

If you make savings a part of your routine, then it does not become a chore or hardship, but something that just comes naturally. Changing your lifestyle – starting new habits – can be difficult. When you make dramatic changes, you get a rush and do fantastic. However, if you crash and burn, then it’s easy to slip into old habits and overcompensate with splurges and large purchases. The best route to success is to take little steps and keep building upon them.

1 – Automate your savings. If you have a direct deposit, start off with a small amount (say $5-10 per paycheck) for a month or two, then increase it by $5 and so on. Digit is a great tool you can use to help get you started with this process, too! I easily saved $300+ dollars the first few months I started using this tool. (Note: In mid-2017 Digit began charging a monthly fee)

2 – Avoid the vending machine at work. I used to have a Mountain Dew habit when I worked full time. The price in our vending machines at work slowly crept up from $0.50 to $0.75. At one soda a day…okay at 2 sodas a day for a work-week, that’s a difference between $5.00 and $7.50. By purchasing a case of soda (12 cans for approximately $2.50) and storing them in my office, I ended up paying as little as $0.21 per can. That’s a $0.54 savings per can – or $1.08 a day (with the 2 cans a day habit that I’ll own up to).

3 – Check your car’s owner’s manual. Oil changes every 3 months or every 3000 miles is the norm we are used to. However, many cars can go longer than that based on the manufacturer’s guidelines. Check your manual to confirm how long you can go between oil changes.

4 – Check the price per unit on your favorite detergent, juices, etc. Just because it’s a larger size doesn’t mean that you’re paying less per unit.

5 – If you purchase items online, price check. Free shipping does not always equate to savings. Sometimes paying to ship on another site can be less than your item with free shipping somewhere else.

6 – Use coupons and savings apps. You don’t have to be an extreme couponer, but those small amounts can quickly add up. You can take it a step further and learn how to use the rewards programs at your local drug stores (CVS and Walgreens) to save even more.

7 – When eating out, order water instead of soda or tea. For a family of 5, if drinks average $2.00 (and that is a low figure) you can save up to $10.00/tax off your meal.

8 – Know the dining specials at your favorite restaurants – when do kids eat for free or a reduced price, buy 1 get 1 dinner or lunch specials, etc.

9 – Give up or scale down on expensive habits like smoking, drinking, shopping, gambling, etc.

10 – Pack snacks and food when going on car trips or even when running errands around town. Having your own food will eliminate stopping at fast food or grabbing items from a convenience store.

Year-Long Savings Challenge

If you’re paid bi-weekly, this 26 Week Savings Challenge may help you.

My children will save an additional penny each day (Day 1 – $0.01, Day 2 – $0.02, Day 365 – $3.65). I shared with my son that he could save over $600 in a year’s time – more than enough for the latest video game console he will most likely have to have at the end of the year. He quickly took on the challenge! We’re making it fun by seeing who will have more in their savings jar at the end of the year (boys versus girls). There will be days we “forget” or get busy, but we’re tracking the weekly amount we need to save and can play catch-up when necessary.

However, you do it; I hope you will include some savings plan with your goals for the upcoming year.

Start small and work yourself up to larger amounts.

Michelle D. Garrett is the founder of Divas With A Purpose.

She focuses on sharing resources for being purposely productive; setting personal and professional goals and achieving them through daily action; and successfully running a business while focusing on your mental health. Michelle is a full-time entrepreneur who specializes in teaching female entrepreneurs how to show up consistently in their business – online and off.